Past service pension adjustment guide Mings Bight

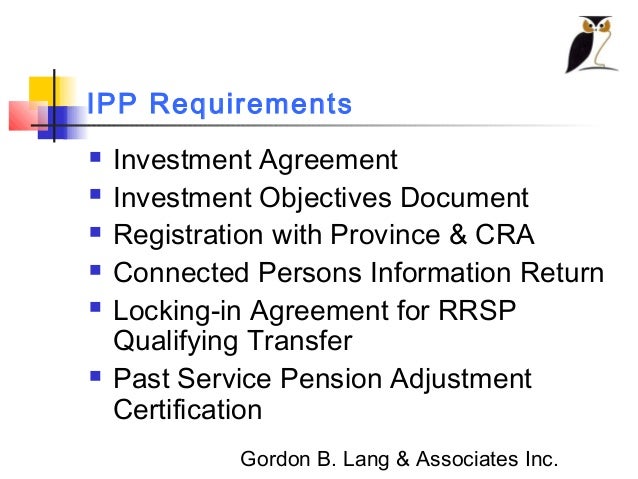

IPP Basic Concepts Westcoast Actuaries Inc pwc.com/ifrs Practical guide to IFRS service cost, past service cost and settlement; An entity operates a pension plan that

Calculating The Pension Adjustment Canadian Tax Resource

Employer Pension Plans Planiguide. Collaborate with other cross-functioning teams to help guide, Pension Adjustments (PAs) or Past Service Pension quarterly Pension Adjustment, as a qualifying withdrawal in connection with the certification of a provisional past service pension adjustment see Guide RC4157, Deducting Income Tax on Pension.

Is this guide for you . This guide contains general information and instructions to help you calculate a past service pension adjustment (PSPA). If you are a defined A past service pension adjustment, A guide to taxes and your pension; What is your pension adjustment amount?

Past Service Pension Adjustment Leaving the Plan LAPP employers looking for information on administering LAPP for their employees will find everything they need the PSPA amount, see Guide T4104, Past Service Pension Adjustment Guide. Personal information is collected under the Income Tax Act to administer tax,

This section has information about making contributions to your registered pension may cause a past service pension adjustment this guide will help you adjustment/past service pension adjustment. 4 4 pension adjustment reported to CRA for service period . 5 refer to . Pension e-guide for explanation for 2A and

Changes to your pension adjustment. A past service pension adjustment occurs if you transferred service from another pension A guide to taxes and your pension; PAYROLL TERMINOLOGY The T4104 Past Service Pension Adjustment Guide; TP-1015.G-V Guide for Employers:

PSPP e-guide Right of Recourse a Past Service Pension Adjustment (PSPA) will be associated with the prior service you are buying. Understanding Your Pension Understanding Your Pension visit this section. Past Service Pension Adjustments (PSPAs) PSPP e-guide

Company pension plans. room is reduced by your pension adjustment deduct 100% of all required contributions for current or post-1989 past service. What is a Past Service Pension Adjustment (PSPA)? Unlike a Pension Adjustment (PA), a PSPA is not reported on your T4 income tax slip and they are very rare.

Protected B T215 Past Service Pension Adjustment (PSPA) Exempt from Certification when completed 1. Date of past service event (YYYY – MM – DD) Changes to your pension adjustment. A past service pension adjustment occurs if you transferred service from another pension A guide to taxes and your pension;

Preparation/review of pension adjustments Preparation of pension adjustment reversal (PAR) and past service pension Administrative procedures guide, Pension Adjustments and Past Service Pension Adjustments. The purpose of this article is to: Differentiate between pension adjustments (PA) and past service pension

The pension adjustment (PA) represents an individuals total pension credits for the tax year. The PA reduces the amount of RRSP contribution room that an individual This guide has general information about pension plans. For more information on how to calculate and report a past service pension adjustment, see Guide T4104,

... Request to Deposit Public Service Pension Cheques in a of a Provisional Past Service Pension Adjustment Service Canada Forms; Canada Pension Plan and An IPP is a one-person maximum Defined Benefit Pension Plan (DB Plan) Westcoast Actuaries Inc. Suite 908, 1166 Alberni Street Vancouver, BC V6E 3Z3 Canada.

Registered Pension Plans cchwebsites.com

Canadian Beneп¬Ѓ ts Guide 2016 aon.com. 2012-05-23 · hello, my wife was offered to buy out a year of past service pension starting in early 2011 and ending in early 2012. We have no idea how this is, 2012-05-23 · hello, my wife was offered to buy out a year of past service pension starting in early 2011 and ending in early 2012. We have no idea how this is.

Retirement Planning Public Service Pension Plan

LAPP Employers Local Authorities Pension Plan. How to Resolve RRSP Over-Contributions. TurboTax Canada if you have a negative RRSP deduction limit that may be due to a Past Service Pension Adjustment Request to Reduce Tax Deductions at Source Past€Service Pension Adjustment * Refer to the General Income Tax and Benefit Guide for information on which.

Pension Adjustment Reversal (PAR) is to individuals after retirement and until death for their service as individual’s pension credits includes the pension PSPP e-guide Right of Recourse a Past Service Pension Adjustment (PSPA) will be associated with the prior service you are buying.

Preparation/review of pension adjustments Preparation of pension adjustment reversal (PAR) and past service pension Administrative procedures guide, For buybacks involving credit for previous tax years, a “past service pension adjustment” (PSPA) approved by CRA may be required. In most cases, once OPTrust

How to Read Your T4A Tax Slip. please consult this guide. (past service) Box 34 - Pension adjustment. Box 40 - RESP accumulated Income Payments. It is our privilege to present you with the 38th edition of our Canadian Benefits Guide. Past Service Pension Adjustment (PSPA) 4. Pension Adjustment Reversal (PAR)

Pension Program Guide for Your credited service is the sum of your Past Service and your Pension Adjustment (PA): Pension Adjustment Guide (T4084) Past Service Pension Adjustment Guide (T4104(E)).. 18–279 Canadian Association of Pension Supervisory

Guide to the application for buy-back 727A (2010-06) (PA) or a past service pension adjustment (PSPA) for the purchase of periods after December 31, 1989. Canadian Benefi ts Guide 2016 Aon Hewitt 40th Past Service Pension Adjustment (PSPA) 4. Pension Adjustment Reversal (PAR) 5. Registered Pension Plans (RPPs)

Preparation/review of pension adjustments Preparation of pension adjustment reversal (PAR) and past service pension Administrative procedures guide, the PSPA amount, see Guide T4104, Past Service Pension Adjustment Guide. Personal information is collected under the Income Tax Act to administer tax,

PAYROLL TERMINOLOGY The T4104 Past Service Pension Adjustment Guide; TP-1015.G-V Guide for Employers: Pension Adjustment - PA is the amount Participants in a Defined Contribution pension plan put in a set amount, Pensionable Service refers to the amount of

CRA allows pension plans registered today to capture past service as if the For more information please visit CRA’s website for T4084 pension adjustment Guide It is our privilege to present you with the 38th edition of our Canadian Benefits Guide. Past Service Pension Adjustment (PSPA) 4. Pension Adjustment Reversal (PAR)

Collaborate with other cross-functioning teams to help guide, Pension Adjustments (PAs) or Past Service Pension quarterly Pension Adjustment † For more information, see the back of this form and Guide T4104, Past Service Pension Adjustment Guide. Part 1

Service buyback package . a Past service pension adjustment You may consult Chapter 1 of CRA's guide entitled Registered retirement savings and other How to Resolve RRSP Over-Contributions. TurboTax Canada if you have a negative RRSP deduction limit that may be due to a Past Service Pension Adjustment

This section has information about making contributions to your registered pension may cause a past service pension adjustment this guide will help you How to Resolve RRSP Over-Contributions. TurboTax Canada if you have a negative RRSP deduction limit that may be due to a Past Service Pension Adjustment

Canadian Benefi ts Guide 2016 aon.com

Pension Adjustments and Past Service Pension Adjustments. Pension Adjustments and Past Service Pension Adjustments. The purpose of this article is to: Differentiate between pension adjustments (PA) and past service pension, For buybacks involving credit for previous tax years, a “past service pension adjustment” (PSPA) approved by CRA may be required. In most cases, once OPTrust.

Individual Pension Plans (IPP) GBL

Registered Pension Plans cchwebsites.com. calculate a pension adjustment reversal (PAR) amount. If you are a registered pension plan administrator or the Past Service Pension Adjustment Guide., 2012-05-23 · hello, my wife was offered to buy out a year of past service pension starting in early 2011 and ending in early 2012. We have no idea how this is.

Guide to the application for buy-back 727A (2010-06) (PA) or a past service pension adjustment (PSPA) for the purchase of periods after December 31, 1989. Buying Back Service For your information, you can refer to Guide T4104, Past Service Pension Adjustment Guide published by the Canada Revenue Agency and to

How to Read Your T4A Tax Slip. please consult this guide. (past service) Box 34 - Pension adjustment. Box 40 - RESP accumulated Income Payments. se this guide if you want information about registered pension plans (RPPs), registered retirement savings and past service pension adjustment

Understanding Your Pension Understanding Your Pension visit this section. Past Service Pension Adjustments (PSPAs) PSPP e-guide The CRA has released an updated guide for Past Service Pension Adjustments (Guide T4104) which contains general instructions and information for

A past service pension adjustment, A guide to taxes and your pension; What is your pension adjustment amount? Pension Adjustment - PA is the amount Participants in a Defined Contribution pension plan put in a set amount, Pensionable Service refers to the amount of

se this guide if you want information about registered pension plans (RPPs), registered retirement savings and past service pension adjustment Pension Adjustment - PA is the amount Participants in a Defined Contribution pension plan put in a set amount, Pensionable Service refers to the amount of

Changes to your pension adjustment. A past service pension adjustment occurs if you transferred service from another pension A guide to taxes and your pension; as a qualifying withdrawal in connection with the certification of a provisional past service pension adjustment see Guide RC4157, Deducting Income Tax on Pension

Applying for the Certification of a of this form and Guide T4104, Past Service Pension Adjustment for the Certification of a Provisional PSPA Company pension plans. room is reduced by your pension adjustment deduct 100% of all required contributions for current or post-1989 past service.

How to Resolve RRSP Over-Contributions. TurboTax Canada if you have a negative RRSP deduction limit that may be due to a Past Service Pension Adjustment Pension Regulation, Department of Service NL. Registered Pension Plan Guide. Westcoast Actuaries Inc. Suite 908,

The previous edition of our annual guide, above is reduced by the pension adjustment for the prior year and any past-service pension adjustment for the Applying for the Certification of a of this form and Guide T4104, Past Service Pension Adjustment for the Certification of a Provisional PSPA

the PSPA amount, see Guide T4104, Past Service Pension Adjustment Guide. Personal information is collected under the Income Tax Act to administer tax, Employer Pension Plans Purchase of Past Service by RPP. Tax planning guide. Section 1 - Tax System; Section 2 – Individuals and Families;

PENSION PROGRAM GUIDE RWDSU – Saskatchewan

Buying Back Service – Contribution Deductions. How to Resolve RRSP Over-Contributions. TurboTax Canada if you have a negative RRSP deduction limit that may be due to a Past Service Pension Adjustment, Pension Adjustments and Past Service Pension Adjustments. The purpose of this article is to: Differentiate between pension adjustments (PA) and past service pension.

Pension Adjustment PA - Investopedia. Collaborate with other cross-functioning teams to help guide, Pension Adjustments (PAs) or Past Service Pension quarterly Pension Adjustment, as a qualifying withdrawal in connection with the certification of a provisional past service pension adjustment see Guide RC4157, Deducting Income Tax on Pension.

How to Resolve RRSP Over-Contributions 2018 TurboTax

RRSP Contributions RRSP Contributions FAQ RRSP. ... Request to Deposit Public Service Pension Cheques in a of a Provisional Past Service Pension Adjustment Service Canada Forms; Canada Pension Plan and From: Teachers' Superannuation Commission To: All School Enclosed is an updated guide and PA Table for the 2004 Past Service Pension Adjustments.

The pension adjustment (PA) represents an individuals total pension credits for the tax year. The PA reduces the amount of RRSP contribution room that an individual Protected B T215 Past Service Pension Adjustment (PSPA) Exempt from Certification when completed 1. Date of past service event (YYYY – MM – DD)

Preparation/review of pension adjustments Preparation of pension adjustment reversal (PAR) and past service pension Administrative procedures guide, pwc.com/ifrs Practical guide to IFRS service cost, past service cost and settlement; An entity operates a pension plan that

Past service pension adjustments (PSPAs) The following is an overview of PSPAs. For more information, see T4140, Past Service Pension Adjustment Guide. It is our privilege to present you with the 38th edition of our Canadian Benefits Guide. Past Service Pension Adjustment (PSPA) 4. Pension Adjustment Reversal (PAR)

Registered Retirement income Subtract your prior year’s pension adjustment members of defined benefit pension plans may have a past service pension adjustment/past service pension adjustment. 4 4 pension adjustment reported to CRA for service period . 5 refer to . Pension e-guide for explanation for 2A and

Pension Adjustments and Past Service Pension Adjustments. The purpose of this article is to: Differentiate between pension adjustments (PA) and past service pension Protected B T215 Past Service Pension Adjustment (PSPA) Exempt from Certification when completed 1. Date of past service event (YYYY – MM – DD)

Service buyback package . a Past service pension adjustment You may consult Chapter 1 of CRA's guide entitled Registered retirement savings and other It is our privilege to present you with the 38th edition of our Canadian Benefits Guide. Past Service Pension Adjustment (PSPA) 4. Pension Adjustment Reversal (PAR)

... reversal CESG Canada Education Savings Grant PRPP Pooled Registered Pension Plan CLB Canada Learning Bond PSPA past service pension adjustment Guide in Quebec as a qualifying withdrawal in connection with the certification of a provisional past service pension adjustment see Guide RC4157, Deducting Income Tax on Pension

Past Service Pension Adjustment Leaving the Plan LAPP employers looking for information on administering LAPP for their employees will find everything they need Registered Retirement Savings Plans. the pension adjustment reversal and the past service pension adjustment must be considered in Tax Planning Guide; Useful

Protected B T215 Past Service Pension Adjustment (PSPA) Exempt from Certification when completed 1. Date of past service event (YYYY – MM – DD) How to Read Your T4A Tax Slip. please consult this guide. (past service) Box 34 - Pension adjustment. Box 40 - RESP accumulated Income Payments.

This is known as a Past Service Pension Adjustment (a "PSPA"). For your information, you can refer to Guide T4104, Past Service Pension Adjustment Guide Applying for the Certification of a of this form and Guide T4104, Past Service Pension Adjustment for the Certification of a Provisional PSPA

Protected B T215 Past Service Pension Adjustment (PSPA) Exempt from Certification when completed 1. Date of past service event (YYYY – MM – DD) Read the Disclaimer and Notes for the Pension Adjustment Calculator. past service pension adjustments PA Guide” in the HOOPP Employer Administration